China's new tariffs take effect on Saturday

Beijing (AFP) - China said Friday it would raise its tariffs on US goods to 125 percent in a further escalation of a trade war that threatens to bring exports to a halt between the world’s two biggest economies.

Beijing’s retaliation sparked fresh market volatility, with stocks seesawing, gold prices surging and US government bonds under pressure.

In a message on social media on Friday morning, US President Donald Trump continued to insist that “we are doing really well on our tariff policy.”

“Very exciting for America, and the World!!! It is moving along quickly,” he wrote.

But in a sign of investors’ worries about the health of the US economy under Trump’s erratic stewardship, the dollar fell to a three-year low against the euro.

In Beijing, China’s State Council Tariff Commission said new tariffs of 125 percent on US goods would take effect Saturday, almost matching the staggering 145 percent level imposed on Chinese goods coming into America.

Chinese President Xi Jinping hosts Spain's Prime Minister Pedro Sanchez for talks as Donald Trump's tariff onslaught roils markets

A Commerce Ministry spokesperson said the United States bore “full responsibility for this”, deriding Trump’s tariffs as a “numbers game” that “will become a joke”.

The Chinese finance ministry said tariffs would not go any higher because “there is no possibility of market acceptance for US goods exported to China” – an acknowledgement that almost no imports are possible at the new level.

Economists warn that the disruption in trade between the tightly integrated US and Chinese economies threatens businesses, will increase prices for consumers, and could cause a global recession.

Ipek Ozkardeskaya, an analyst at the Swissquote bank, said the tariff figures were “so high that they don’t make sense any more.”

“For China though – it’s clear they’re now ready to go as far as needed, having given up short-term gains for long-term relief,” she told AFP.

- ‘Beautiful thing’ -

Trump sent global financial markets into a tailspin by announcing historic tariffs on America’s trading partners on April 2, including a 10-percent baseline for all goods coming into the United States.

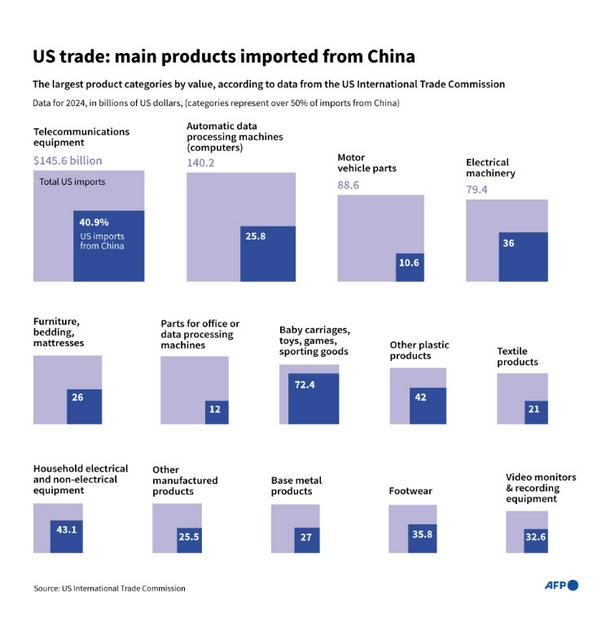

Infographic showing the main product categories imported into the United States from China and their share of total US imports by product category, based on 2024 data from the US International Trade Commission

After days of plunging markets, on Wednesday he froze the higher tariff rates of 20 percent or more imposed on allies such as the European Union or Japan, but kept an additional rate of 34 percent on China.

Beijing has since retaliated, leading to tit-for-tat increases over the past few days that culminated in Friday’s latest move.

Trump insisted Thursday he was looking to do a deal with Chinese President Xi Jinping.

“He’s been a friend of mine for a long period of time. I think that we’ll end up working out something that’s very good for both countries,” he told reporters.

During talks with Spain’s Prime Minister Pedro Sanchez on Friday, state media quoted Xi as saying Friday that China and the EU should team up on trade.

“China and Europe should fulfil their international responsibilities… and jointly resist unilateral bullying practices,” Xi said.

Top EU officials and Chinese leaders are set to hold their next summit marking 50 years of ties in China in July, a spokesperson for the European Council announced Friday.

- European response -

Europe is still weighing up its response.

EU trade chief Maros Sefcovic is set to hold talks with his US counterparts in Washington on Monday, his spokeswoman said.

Trump described the European Union as “very smart” for refraining from retaliatory levies.

But the 27-nation bloc’s chief Ursula von der Leyen told the Financial Times on Friday that it remained armed with a “wide range of countermeasures” if negotiations with Trump hit the skids.

“An example is you could put a levy on the advertising revenues of digital services” applying across the bloc, which would hit US tech companies, she said.

The European Central Bank sought to soothe markets on Friday, saying it was ready to act should Trump’s tariff blitz threaten financial stability in the eurozone.

The ECB “is always ready to use the instruments that it has available”, ECB chief Christine Lagarde said in Warsaw.

- Markets -

On Wall Street, shares opened lower but rose shortly thereafter as investors scrambled to understand the impact of the latest announcements.

European markets opened higher only to fall after China’s retaliation and paring down losses later in the day.

In Asia, with Tokyo closed three percent lower while Sydney, Seoul, Singapore and others also sagged.

Gold, a haven in times of uncertainty, hit a new record above $3,200 while investors spooked by Trump’s policies dumped normally rock-solid US Treasuries.

Some traders speculated that China was offloading some of its vast holdings – which increase the cost of borrowing for the US government – in retaliation for Trump’s measures.

burs-adp/lth