US President Donald Trump's shifting positions on tariffs have sent the world's stock markets seesawing

Washington (AFP) - President Donald Trump pledged Friday that his tariff policy is working and will benefit the United States and the world, despite China hiking tariffs on US goods to 125 percent in a deepening trade war.

Traumatized stock markets seesawed, the dollar tumbled and US government bonds faced renewed pressure after Beijing’s retaliation intensified the confrontation between the world’s two biggest economies.

In a message Friday on social media, Trump continued to insist that “we are doing really well on our tariff policy.”

“Very exciting for America, and the World!!! It is moving along quickly,” he wrote.

Trump sent global financial markets into a tailspin by announcing sweeping import taxes on dozens of countries last week, only to abruptly roll them back to 10 percent on Wednesday – although hiking them for China.

But the subsequent bounce in the markets has faded with the realization that the Washington-Beijing trade war is still spiraling.

Chinese President Xi Jinping has said his country is 'not afraid' of a trade standoff with the United States, state media quoted him as saying

Chinese President Xi Jinping gave his first major comments on the tensions on Friday, with state media quoting him as saying his country was “not afraid.”

Xi also said the European Union and China should “jointly resist unilateral bullying practices” during talks with Spain’s Prime Minister Pedro Sanchez.

- ‘Numbers game’ -

Then, Beijing announced that new tariffs of 125 percent on US goods would take effect Saturday – almost matching the staggering 145 percent level imposed on Chinese goods coming into America.

A Chinese Commerce Ministry spokesperson said the United States bore full responsibility, deriding Trump’s tariffs as a “numbers game” that “will become a joke.”

But China’s finance ministry said tariffs would not go any higher in an acknowledgement that almost no imports are possible at the new level.

China's new tariffs of 125 percent on US goods were set to take effect on April 12, 2025

Trump had reiterated on Thursday that he was looking to do a deal with Xi despite the mounting tensions.

“He’s been a friend of mine for a long period of time. I think that we’ll end up working out something that’s very good for both countries,” he told reporters.

But US officials have made it clear they expect Xi to reach out first.

Pressure was growing on Trump, however, as markets continued to fret.

Yields on crucial US government bonds, which are normally seen as a safe haven, were up again Friday, indicating weaker demand as investors take fright.

Trump admitted he had been watching people get “queasy” over the bond market before making his stunning tariffs backtrack.

Some traders speculated that China was offloading some of its vast holdings – which increase the cost of borrowing for the US government – in retaliation for Trump’s measures.

In a further sign of investor worry, the dollar fell to a three-year low against the euro and prices of gold, another safe haven, surged.

Policymakers at the US Federal Reserve meanwhile warned of higher inflation and slower growth ahead due to Trump’s tariff policy.

- ‘Countermeasures’ -

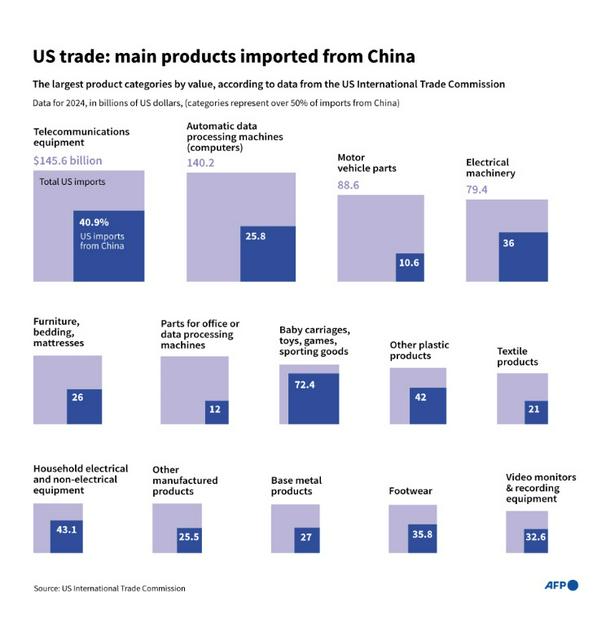

Infographic showing the main product categories imported into the United States from China and their share of total US imports by product category, based on 2024 data from the US International Trade Commission

Economists warn that the disruption in trade between the tightly integrated US and Chinese economies will increase prices for consumers and could spark a global recession.

Ipek Ozkardeskaya, an analyst at Swissquote bank, told AFP the tariff figures were “so high that they don’t make sense any more,” but said China was “now ready to go as far as needed.”

The rest of the world is still calibrating its response.

Trump on Thursday described the European Union – which was originally hit with 20 percent tariffs by Trump – as “very smart” for refraining from retaliatory levies.

Top EU officials and Chinese leaders are set to hold their next summit marking 50 years of ties in China in July, Brussels announced. EU trade chief Maros Sefcovic will meanwhile hold talks in Washington on Monday.

But the 27-nation bloc’s chief Ursula von der Leyen told the Financial Times on Friday that it remained armed with a “wide range of countermeasures” including a possible hit on digital services that would strike US tech firms.